Impact Investing is now front and center for many people and institutions, and is no longer a choice of either/or. That is, a trade-off no longer exists between changing the world and making compelling financial returns. Look for Impact Investing to continue staking out its turf on the investment landscape, with a proven track record of impact and economic benefits.

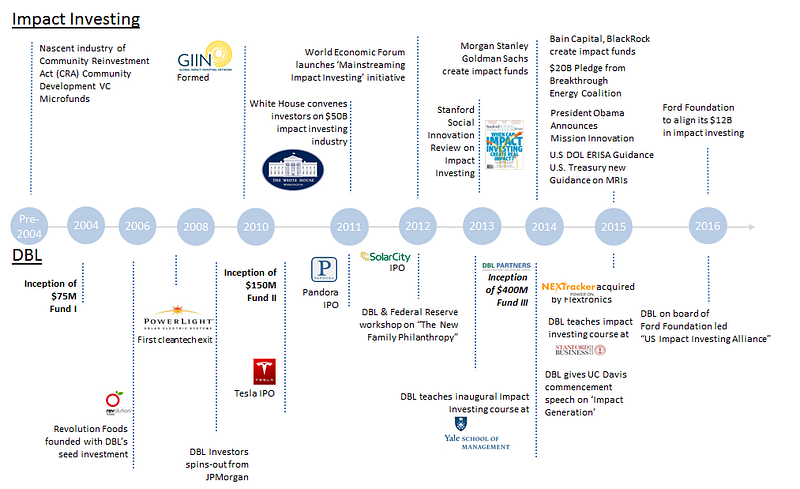

As the diagram above explains, before 2004, domestic impact investing was a nascent industry largely comprised of small VC funds supported by community reinvestment investors along with some foundation PRI investors. The term “impact investing” didn’t even exist at this point. In 2004, we closed our first fund at $75M, supported by many banks and foundations like Ford, MacArthur, Annie E. Casey and The F.B. Heron Foundation. Within four years we had our first significant cleantech exit and had spun out of JP Morgan to create DBL Investors. Shortly after, the GIIN was founded and the world was starting to get a taste for the positive role that investment could play in addressing social and environmental issues.

The next few years were a whirlwind of highs and lows for DBL and Impact Investing alike. The economic crisis of 2008 took its toll on the industry, and many firms struggled to keep companies afloat. Then, from 2010 to 2012, DBL experienced the IPOs of Tesla, Pandora and Solar City at the same time that Impact Investing was starting to gain traction. After closing our third fund in 2015 and looking back at the last decade, it would have been almost impossible to predict how big and bold impact investing was to become. The fact that our fund was oversubscribed at $400M — a very large fund — would never have been something we would have envisioned even two to three years ago. Now, Impact Investing is continuing to go mainstream. Large financial firms like Goldman Sachs, BlackRock, and Bain Capital have joined the field by launching investment products incorporating ESG and impact factors.

Impact Investing: Why You May Need A Thick Skin

Around the DBL conference table, we are constantly taking stock of the field and of our own efforts and asking, how can we do better? How can we go faster? How can we get bigger? As an Impact Investor, we ask these questions because we are convinced of our collective ability to build companies and change the world for the better at the same time. By working with these mission-driven companies we are able to show what is core to Impact Investing: No Sacrifice.

What does No Sacrifice mean to DBL? It means this: Market rate, mission-related investments are fundamentally financial investments meeting prudent investor standards across all asset classes. And yet, they go far beyond this financial metric with a plethora of social impacts. These social impacts range from climate change to income inequality to diversity and economic development. At DBL, we are making an effort to broaden our impact reach. For example, currently there are over 1.3 billion people on this planet who do not have access to electricity. These people face significant barriers to economic betterment and health improvement. No Sacrifice means ensuring that we launch investment efforts so that all of these people not only have the electricity to better their world, but that the world creates more electricity that does not continue to harm. It means facing the immense environmental threats from climate change with innovative, scalable solutions that create quality jobs and strengthen communities. And it means that while pushing for this progress and innovation we go further. We also push for equality of opportunity, closing gender gaps, minority gaps, unconscious bias, conscious bias, and the other social dysfunctions that hold us back.

To many, these epic challenges seem overwhelming. Yet, for Impact Investors, including DBL, these social and environmental threats show the massive and critical need for finding innovative solutions. They should only heighten our sense of action to motivate us to take on challenges that skeptics deem impossible. As a result, we at DBL are full steam ahead into new and unknown territory, becoming more vocal, spending as much time as we can squeeze in on advocacy and education. And in the process, sometimes, we have no choice but to develop a thick skin.

Impact Investing is wholly based on people. People who have the belief that they can change the world, with the imagination to dream up innovative solutions, and the tenacity to work on the world’s most challenging problems. At DBL, we do so with pride, and we often find ourselves actualizing this commitment by working hard on policy. Our efforts with SolarCity on the rooftop solar story is a well-known policy example currently bubbling in impact investing circles, but it is by no means the only one. Nutrition standards, bans on sugar, transportation taxes on imports to reflect carbon impacts, increasing diversity targets in Silicon Valley and Sand Hill Road, developing appropriate employee protections for the gigeconomy: these are a sampling of what is in store for impact investors on the policy front. An impact investor has to engage. You most assuredly will not win every policy battle, but you have to engage. That’s where the thick skin comes in handy. Change at this level just doesn’t happen on its own. And investors have an important voice to add to these policy narratives.

Innovation, Impact and Risk

Another driver of our investment philosophy at DBL is to recognize the importance of innovation cycles. Being based in Silicon Valley, we hear the word innovation on an hourly basis. We have seen many innovation cycles over the past several decades, including in computers and telecom. As history repeats itself, we know that there are going to be skeptics every step of the way, and that innovation coupled with impact may attract even more naysayers than traditional early stage investing. Still, we have learned that the greatest venture investment opportunities lie at the onset of innovation cycles, and that capturing social change cycles at the same time can be almost magical. After almost 100 years of being relatively steady state industries, the energy and automotive sectors are entering an era of transformation and innovation. Changes in popular sentiment and approaches are propelling new generations of startups that are built on the backs of the first generation companies and pushing us even further into the future. There will be incumbent tensions and even legal actions, but the path toward 21st century businesses that address environmental and social needs of the 21st century in favour of 20th century approaches is an inexorable one. New startups are becoming stronger and building products better than we ever thought was imaginable. After fighting all of these battles for the past decade, we have seen the incumbents start to move from denial to fighting back to eventually forging some kind of coexistence. It’s a well-worn path that, as impact investors, we need to keep in perspective.

And now, back to taking more risks. DBL invested in Tesla in 2006. Back then, that was an incredibly risky decision: By contrast, investing in an electric vehicle in 2016 is risky in another way: Been there, Done that. So today, we are looking at new areas in transportation that we call the transportation trifecta: electrification, autonomy, and ridesharing. We’re also looking at the connection between electric vehicles and greening the grid. We are evaluating many deals in these areas, and it helps to have the learnings from Tesla as well as SolarCity to help sort out these investment opportunities.

We are also taking our learnings from the U.S. solar market to address the off-grid solar market in Africa. One of our new investments: Off-Grid Electric (OGE) provides small solar/battery systems and energy efficient appliances to homes in Tanzania and Rwanda. The systems take advantage of the high penetration of mobile telecommunications technologies by allowing customers to pay for power with their cell phones. This is our first international investment and represents a big stretch for us. We had to consider political risk, currency risk and economic development risk in a manner very different from our U.S. investment process. At the same time, we strongly believe in the business model of OGE and its potential to combine extraordinary social impact and financial returns.

Impact Investing: Joining the Head and the Heart

At DBL we hold ourselves accountable. We push to create a body of work that satisfies both the head and the heart. As Impact Investors, we are accountable not only for the decisions and investments we make today, but also for their broader impact across generations. It is a demanding path to choose, full of failures and successes, setbacks and breakthroughs. And yet, when all is said and done, we wouldn’t have it any other way.

*The author would like to thank Jake Young, Analyst at DBL Partners, for his assistance working on this paper.